Quietly but consistently, Meta has been expanding the capabilities of its WhatsApp messaging platform, signaling a clear intent to morph it into a super app—a model that has achieved immense success in Asian markets. In regions like China (WeChat), Singapore (Grab), Indonesia (Gojek), and India (Paytm), these apps have seamlessly integrated a wide array of essential services—from communication and financial transactions to social interaction, shopping, and ride-hailing—all within a single, unified platform. However, a similar widespread adoption has yet to materialize in Western markets.

Paul Armstrong, founder of TBD Group, a technology consulting firm, clarifies that Meta’s approach isn’t a direct copy of WeChat. Instead, they are strategically “abstracting the core user behaviors that truly matter.” He emphasizes that WhatsApp’s underlying architecture was not designed to accommodate the sheer breadth of WeChat’s functionality, which even extends to government services.

Furthermore, regulatory frameworks in Western nations are unlikely to permit such extensive integration. Therefore, Meta is adopting a strategy of layering in lighter versions of these capabilities. These additions are designed to be contextually relevant, easy to use, and unobtrusive when not actively needed. The outcome is not a Western clone of WeChat, but rather a modular system that shares a similar behavioral footprint—transactional, sticky for users, and increasingly facilitated by AI-driven agents.

Roadblocks to Super App Development

Ross Rubin, principal analyst at Reticle Research, highlights a significant hurdle for any emerging super app in the United States: the entrenched dominance of the two major app store ecosystems, Apple and Google. Unlike China, which boasts a more fragmented app store landscape, in the U.S., these tech giants already control vast portfolios of popular apps across various service categories. This presents a formidable challenge for a super app, as it must compete to win users away from well-established platforms like Uber. Malik Ahmed Khan, a technology equity analyst at Morningstar Research Services, explains the difficulty: it’s incredibly tough for a super app to gain traction if its goal is to shift users from dominant apps, especially if companies like Uber are unwilling to yield their user base.

Adam Landis, head of growth at Branch, concurs that restrictive app store policies, particularly Apple’s, have historically stifled super app development in the U.S. through limitations on payment systems and third-party app distribution. However, with Apple’s gradually loosening grip—evidenced by pressures to permit app sideloading in the European Union or potential changes in payment policies—the door for genuine super app adoption might finally be opening. Landis further suggests that Artificial Intelligence (AI) will be a primary accelerator in the evolution of digital commerce. By constructing a self-contained commercial ecosystem within WhatsApp, Meta can leverage behavioral data and transactional intent to drive the next wave of AI-powered commerce. Moreover, platforms like OpenAI, with their capacity for persistent context and multi-service interfaces, could themselves transform into “super apps in disguise,” autonomously managing discovery, decision-making, and transactions.

Trust and User Privacy Concerns

Khan also identifies data privacy as a substantial challenge for Meta’s super app aspirations. Should Meta integrate such a diverse range of services into one application, users might reasonably question, “Do I want Meta knowing when I order an Uber or where I’m going?” Jennifer Golbeck, a professor at the University of Maryland, adds that while payment convenience is highly appealing, consumers are also justifiably concerned about their financial privacy and security. Would they trust this company with their credit card and banking information? Is there a risk of unexpected charges or fraud?

Golbeck argues that for new super apps to genuinely displace or dominate existing mobile payment options, they must offer clear added value or a superior level of convenience. Meta’s past attempt to launch WhatsApp payments in India, despite regulatory hurdles being removed, ultimately failed to gain significant market share against established systems like Google Pay. This illustrates that creating genuine demand for a new payment system, amidst the prevalence of existing, well-entrenched options, remains a critical question.

Chris Sorensen, CEO of PhoneBurner, acknowledges that the potential demand for a WhatsApp super app might be greater in developing markets, where limited bandwidth and app storage make all-in-one solutions highly attractive. However, in Western markets, resistance is more pronounced because consumers are generally more privacy-conscious and hesitant to grant too much control to a single company. He also underscores that developing a super app necessitates extensive integrations and significant shifts in user behavior, which certainly won’t happen overnight.

Meta’s Data Strategy Via WhatsApp

David Bader, director of the Institute for Data Science at the New Jersey Institute of Technology, explains that the question of consumer demand varies significantly based on market maturity. In emerging markets, super apps often provide tangible solutions to real infrastructure problems—such as fragmented payment systems or limited internet access—by offering efficient, integrated services. However, in mature markets like the U.S., the value proposition of a super app is less clear, as consumers already have specialized apps that function effectively. Resistance frequently stems from concerns about trust and privacy, which are amplified when users are asked to consolidate their entire digital lives into a single platform controlled by one entity.

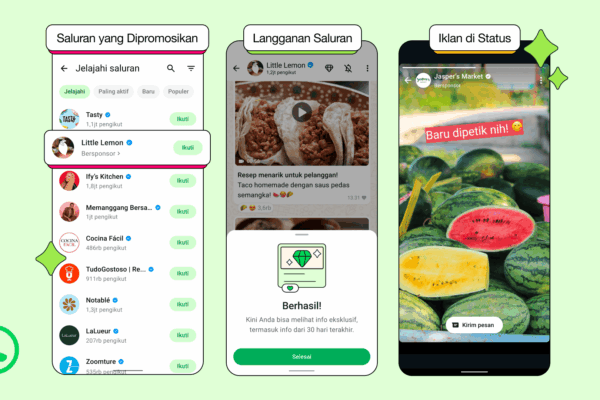

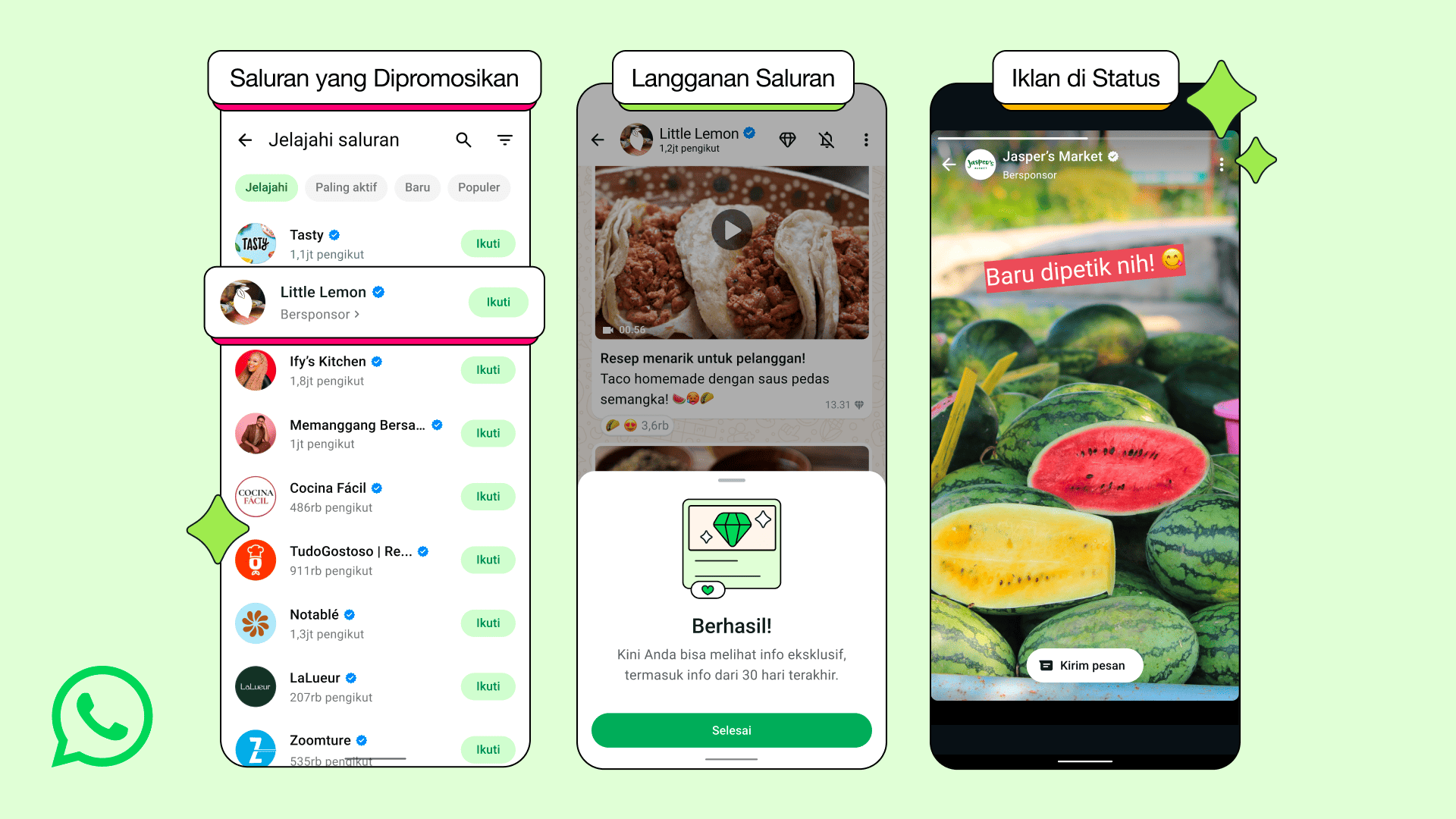

From a technical perspective, Meta is unequivocally positioning WhatsApp to become a super app. The integration of business services (like enhanced WhatsApp Business features enabling direct customer interaction for SMBs), AI-powered agents (such as Meta AI now directly integrated within WhatsApp for queries or tasks), and the gradual introduction of payment systems (like WhatsApp Pay, which continues to be piloted in various countries) all indicate a clear platform consolidation strategy. Bader specifically highlights how Meta is leveraging its AI capabilities, particularly the Llama models, to create contextual experiences within conversations. This is not merely feature addition, but rather an “algorithmic orchestration of user needs.”

“Meta’s motivation is fundamentally about data and control,” Bader asserts. As a data scientist, he explains that fragmented user experiences lead to fragmented datasets. By consolidating interactions within WhatsApp, Meta gains unprecedented visibility into user behavior patterns across the entire customer journey—from discovery to purchase. This creates enormous competitive advantages in AI development, more targeted advertising, and more accurate predictive analytics.

Considering WhatsApp’s massive existing user base in Indonesia, how do you foresee Meta’s strategy playing out: will it successfully compete with or rather complement the established super app ecosystem already dominated by Gojek and Grab?